Data Shows Why Investors Esperan A Major Shift In Global Interest Rate Policy Globl Terest Rte Movements 2011 Centrl Bnk News

Cfr's global monetary policy tracker compiles data from 54 countries around the world to highlight significant global trends in monetary policy. Overview of worldwide interest rates | central bank rates | central bank decisions | monetary meeting How did other factors such as risk appetite in global financial markets contribute to the exchange rate movements

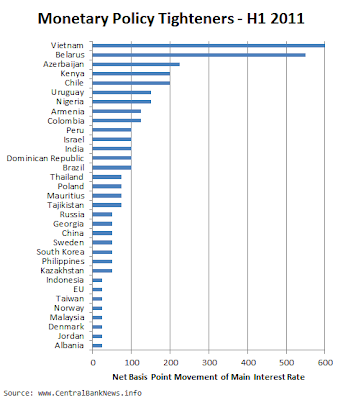

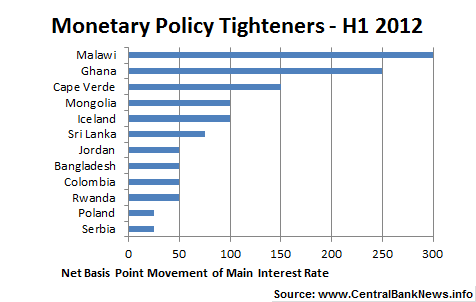

Global Interest Rate Movements in 2011 - Central Bank News

To answer these questions, we use survey and financial asset price data and examine how interest rate surprises correlated with changes in exchange rates since early 2021 Morgan global research's price forecasts is continued strong investor and central bank gold demand, which is projected to average around 585 tonnes a quarter. Our findings can be summarized as follows:

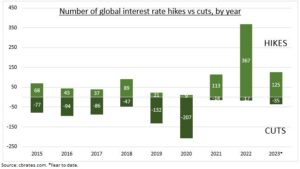

Differences in global interest rates are a major driver in the ebb and flow of investment capital—and unexpected monetary policy moves can send waves through markets.

What's the outlook for interest rates for 2026 and beyond Thereafter, it is projected to hike by 25 bp in the third quarter of 2027, bringing the upper band for the policy rate back up to 4%. Interest rates remain central to global economic strategy For investors and institutions alike, understanding rate trends is critical to navigating the complexities of modern financial markets.

Gone is the era of secular stagnation characterized by low inflation, low interest rates, a global savings glut and sagging aggregate demand. Easing, japan tightening and others likely on hold Surveys of professional economic forecasters and financial market data can reveal public perceptions about the future conduct of monetary policy Current estimates suggest that both professional forecasters and investors expect the federal reserve to respond strongly and systematically to changes in economic conditions

The current perceived responsiveness to inflation is particularly high.

Central banks are pivoting toward easing monetary policy, though at varied speeds and magnitudes depending on regional economic conditions Understanding the trajectory of these rates is crucial for investors, businesses. Against a backdrop of uneven monetary policy, ai expansion and intensifying market polarization, what's the outlook for equities, commodities and more? While some of these arguments have also been directed to policy makers, analysts, and investment funds, the analysis presented in this article (and in the accompanying piece how to make esg real ) is focused at the level of the individual company

Does esg really matter to companies? Mckinsey's global banking annual review offers the best of our research into the global banking industry Explore the findings from our latest 2025 report. View data of the effective federal funds rate, or the interest rate depository institutions charge each other for overnight loans of funds.

Chapter 1 describes how financial conditions tightened abrubtly with the onset of the pandemic, with risk asset prices dropping sharply as investors.

Three factors are driving us toward a major shift in consumption patterns where consumers will consider sustainability as a baseline requirement for purchase 1) trust drives behavior and. This holds true even for investors who are very interested in sustainable investing (62%) and those who rate climate action as a top investment interest Just 21% of global investors would avoid traditional energy companies altogether on climate grounds, indicating that investors may be open to supporting companies with a clear transition plan.

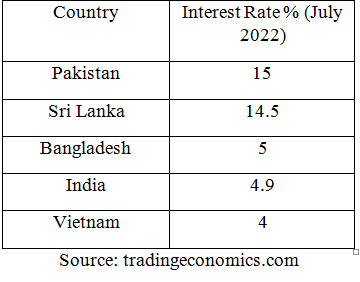

The benchmark interest rate in the united states was last recorded at 3.75 percent The yen is plummeting and inflation is climbing, but japan's economic circumstances have led to a view that raising rates would do more harm than good. Moody's creditview is our flagship solution for global capital markets that incorporates credit ratings, research and data from moody's investors service plus research, data and content from moody's analytics. In particular, major emerging markets have been more insulated from global interest rate volatility than would be expected based on historical experience, especially in asia

There are other signs of resilience in major emerging markets during this period of volatility

Exchange rates, stock prices, and sovereign spreads fluctuated in a modest. In mckinsey's latest annual global private markets report we look at some of the biggest trends shaping private equity in 2025 and beyond. Following gold's relentless run higher, some investors have questioned who the major buyers of gold will be in 2026