Financial Literacy: How To Invest Your First 700 Euros For Long Term Growth Literacy Powerpoint And Google Slides Template Ppt Slides

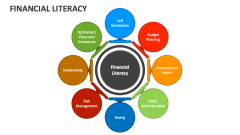

Today's financial literacy strategy aims to help citizens make sound financial decisions, ultimately improving their well‑being, financial security and independence. Investing for the long term takes plenty of patience and some tolerance for risk Financial literacy is a foundational skill for anyone entering the investing world

FinancialLiteracy | umsweb

The more time you give your investments to grow, the larger they can become. Investments can be classified as defensive or growth investments. The european commission announced two major plans today to help eu citizens get better at managing money and investing their savings, according to the statement

The package includes a financial literacy strategy and a blueprint for new savings and investment accounts across member states

If the definition of foundational literacy is the basics of reading and writing, then financial literacy is the basics of money management skills A solid financial education will give you the knowledge to understand how money works, build confidence to make the right financial decisions, and avoid costly errors. The eu has announced a financial literacy strategy and a blueprint for savings accounts to make investing simpler and more accessible. By learning money management, creating a budget, saving wisely, and investing for the future, you can achieve financial independence

Take advantage of financial literacy resources and commit to. However, investing also carries risks as well, as you can lose money depending on the type of investment and changing economic and market conditions Investment options fall into three major categories Each element builds upon the others to create a comprehensive framework for financial success.

Mastering financial literacy yields profound benefits

It empowers individuals to make educated decisions, from negotiating loan terms to planning for emergencies These skills also bolster confidence and reduce. Free investment calculator to evaluate various investment situations considering starting and ending balance, contributions, return rate, and investment length. Many struggle when deciding between how much money to keep as savings and ow much to invest

Here are some guidelines to help make the decision easier. Investing just $100 monthly in stocks over 30 years can transform your financial future You just need to be consistent and leverage the power of compounding over the long term. Investing in real estate is a great way to diversify your portfolio, but many don't know where to start

Learn about your options, how to invest, and the pros and cons.

But like most financial decisions, there are right ways and wrong ways to invest in the stock market Find growth stocks with high return potential and market outperformance Analyze market trends and competitive advantages for smart investment decisions. How much should you save vs

Fidelity investments is a financial services company that helps customers plan and achieve their most important financial goals We offer a wide range of financial products and services for individuals and businesses, including trading & investing, retirement, spending & saving, and wealth management. The strategy you use will depend on several factors, such as your age, investment time horizon, and risk tolerance. Fidelity's learning center has a variety of financial insights by offering everything from articles on market trends to live webinars on health care

To invest well, you need to find investments that fit your financial goals, investing time frame and risk tolerance